The key component of solar cells, Polysilicon, has dropped to record low prices and isn’t expected to rise any time soon.

Polysilicon is form of silicon that is hyper pure, and the second most abundant element on earth.

Silicon based Solar PV modules use polysilicon as an initial building block in manufacturing.

According to data from Bloomberg New Energy Finance, there is such a huge supply of polysilicon that suppliers all over the world are losing money at spot prices.

In the past year, prices are down 31 per cent, reaching just $14.76 per kilogram this month.

Manufacturers of polysilicon are reluctant to limit production as the solar power demand is rapidly increasing, making it unlikely that this global excess will ease, says New Energy Finance lead solar analyst Jenny Chase.

This surplus illustrates that the solar industry is encountering some ‘growing pains’ on its rise which will soon see it becoming a mainstream energy source.

Ms Chase stated in an interview that “It’s another sign of how good the solar industry is at losing money,”.

“You don’t want to close an entire factory just because of a temporary drop in prices. It can take six months to shut down and start up again,”.

Low polysilicon prices taking a toll

A solar analyst at San Francisco-based GTM research, Jade Jones, said that with prices this low, it wont be long before producers start to slow down.

On a basis of manufacturing costs, a fair price of $20 indicates a healthy industry.

As demand climbs in the fourth quarter, Ms Jones said they expected prices to begin to tick-up.

An unsustainable price war has been created thanks to a competition increase to gather market share.

“If the price stays this low in 2016 then I’d expect ramp-downs,” she said.

Dow Corning Corp, a leading global supplier of silicones and silicones solutions blamed their nine per cent decrease in third-quarter sales on declining polysilicon revenue.

J. Donald Sheets, the Cheif Financial Officer stated that on top of low prices, order are being delayed.

“Results continue to be impacted by fewer polysilicon shipments to Hemlock Semiconductor’s long-term contract customers,”.

In early 2008, polysilicon was in its peak success and going for around $475 per kilogram; the current price is a giant drop.

Long-term contracts signed by panel makers back in those days are still benefiting some companies.

Solar Industry

In 2014, 90 per cent of the worldwide polysilicon supply went into solar panels, which was a 27 per cent climb from 2001.

A 30 per cent climb is expected for panel demand this year, however the capacity of polysilicon is also increasing.

According to New Energy Finance, there are plans to increase the current polysilicon production capacity of 350,000 metric tons up at least 10 per cent.

The existing inventory paired with that oversupply, will pressure prices even more.

The second largest producer Wacker Chemie does not have the same view.

Chairman Peter-Alexander Wacker predicts a rebound due to excess supplies being used in the high demand of solar panels in China and the U.S.

“We always have swings based on demand but this trough in price seems to be saying that even the biggest producers are finding it difficult to rein back production,” Mr Wacker said.

The company’s third-quarter earnings presentation unveiled plans of a new Tennessee factory and that they will continue to run the other factories at full capacity.

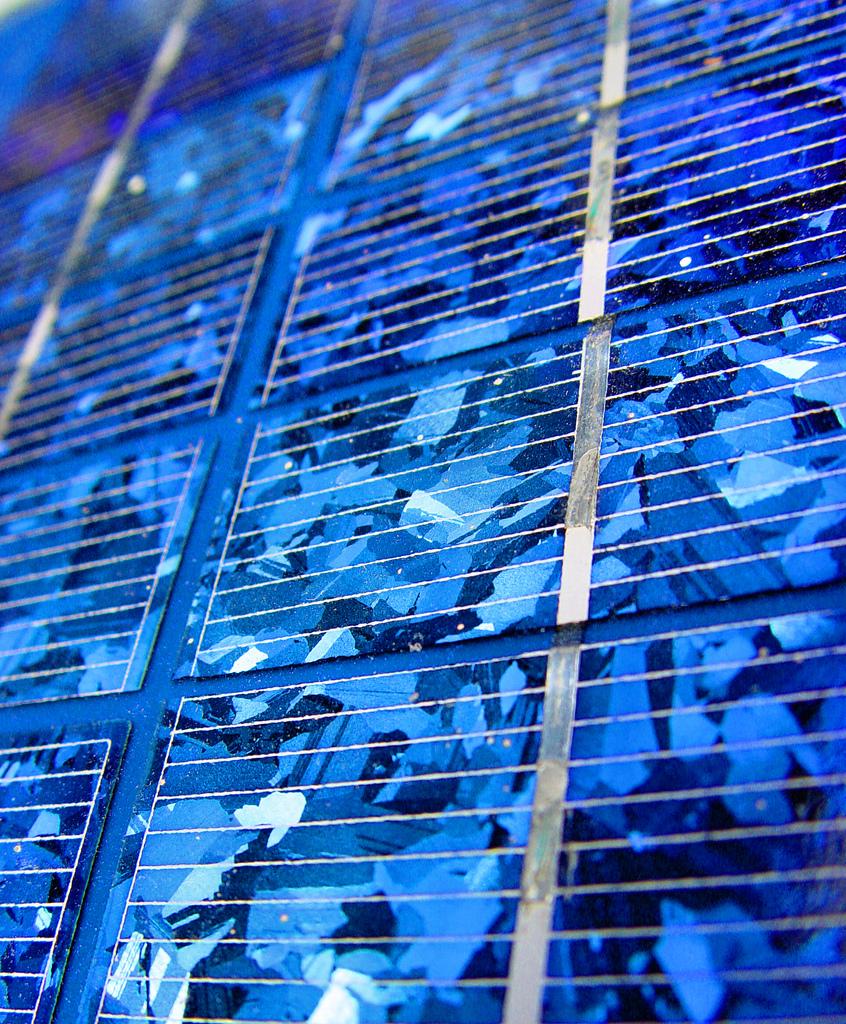

Photo courtesy of Scott Robinson