From remarkable car company displays to countless stands all-filled up with automotive-related products, the entire show was extremely massive and more auto-focused.

And the reason for all that is obvious; with the revolution of connected cars, electric cars and autonomous cars taking shape, the automotive industry is becoming flooded by tech companies. In the near future, don’t be so surprised when your car becomes more than just a dumb motor affixed to a couple of wheels.

The giant tech companies charging full steam into the seemingly lucrative automotive industry include Google, Apple, Uber as well as Nvidia—which was once a renowned video graphics specialist. There’s no doubt that these new arrivals will give automotive executives sleepless nights.

Truth be told, these companies are damn moneyed and need to spend heavily on something. At some point, Apple considered a takeover of McLaren, a Cupertino-based company which boasts a market capitalisation of a whole USD $630 billion (AD $860 billion). Similarly, Google is considered worth USD $566 billion ($776 billion).

Compared to Ford and General Motors, with each being valued at about USD $50 billion ($68 billion), and the Renault, Nissan and Mitsubishi alliance coming in at about USD $70 billion ($95 billion) combined, the future certainly looks bleak for conventional car makers as they face-off the biggest revolution and challenge in their history.

Practically, Apple and Google have the option to acquire a controlling stake in GM, Ford, Mazda and Mitsubishi, as well as Volkswagen ($100 billion) combined, with all their free cash (held safely in Ireland). In essence, the car producers are facing fierce competition from companies working with huge margins and feel no pain spending billions on R&D without any return.

However, while Apple and Google have the know-how to make a pretty intelligent piece of tech—, they definitely have no clue on how a car is made. Similarly, while Mercedes makes incredible cars, its connected-car and digital integration services aren’t even close to matching the functionality of the latest smartphone.

Redefining The Game

Today, it’s all about how fast car companies can make autonomous technology using artificial intelligence that is truly functional versus how tech companies can quickly learn how to make unique cars fully integrated with highly advanced digital technologies and artificially intelligent systems.

Google’s learning system certainly represents the future of artificial intelligence. The multi-billion company has changed its focus to artificial intelligence and this is bound to compel the world to change as well. Both Apple and Google have become very ambitious and really looking to grow, thanks to the man Elon Musk.

Currently, Musk’s Tesla is worth more than Mitsubishi, Mazda, and Suzuki combined, and only 25 per cent fewer than General Motor and Ford. Think about it for a second. Tesla produces less than 100,000 cars a year while the three car makers manufacture more than 4 million cars annually, yet, the trio is worth around half of Tesla’s value.

The entrance of the tech giants and Tesla will sure scare the hell out of traditional car companies. Notably, the cars and mobility industry is rapidly changing. Even though the car companies mentioned earlier really understand how to make a seamless internal combustion, Tesla’s electric cars comfortably sit on the forefront. Why would Tesla be the first car company to launch an autonomous driving technology that goes beyond a concept?

Most car companies have been operating like established political corporations that are often overwhelmed with bureaucracy—while Apple, Tesla and Google operate like the tech gurus they are, who make things happen at a faster rate and leaner processes.

Whether technology giants or vehicle manufacturers, all these present valuable solutions to issues that concern future mobility—only the perspective differs.

On the other end, Uber and Ford foresee a future with car sharing as the norm, while Nvidia, popular for ensuring beautiful graphics becomes possible, is already making a big deal of the hardware that powers the Tesla Autopilot system and is looking to strategically position itself as the Bosch of modern automotive era by making commoditised vision processing and artificial intelligence systems. The company’s shares have gone up by over 400 per cent in the last 12 months.

Generally, the atmosphere surrounding autonomous car systems is electric. Every auto manufacture is focusing on producing the best system even though they were all at some point surpassed by American upstarts.

Nissan and Volkswagen sure made their biggest deals in their autonomous vehicle technologies in the 2017 CES. Nissan’s man-in-the-middle approach (SAM) concurs that autonomous cars can’t work on their own. They’ll need to be monitored by a human so that in case things go haywire, someone can dial in and direct the car’s artificial intelligence on what to do. Well, that doesn’t make the car autonomous anymore, isn’t it?

To be specific, during their latest Nissan SAM live demo, the system actually froze. Not once; twice! The autonomous car got stuck and no one could come to its rescue. The company pointed to a failed satellite link as the reason for the mishap, clearly indicating unavailability of an effective backup solution. Like seriously? Does it mean no one thought of backup as a way of fixing the obvious point of failure?

Similarly, Volkswagen encountered the same kind of failure when demonstrating its autonomous car technology. While this was happening, the number of Tesla’s Autopilot 2 system in the hands of customers was rising. Today, there are 1000 of the company’s autonomous cars being tested in the real world.

Apparently, Mercedes which is currently valued at $110 billion is the only company that appears to come close to Tesla, with its brand of autonomous car technology set for launch later this year. The technology’s initial phases are already available in the S, E and C-Class.

Notably, Mercedes acquired a 9.1 percent stake in Tesla in May 2009, before going public for approximately $50m. In October 2014, the company disposed of its shares, generating a whopping $780m.

One of the biggest advantages of tech companies over vehicle manufactures isn’t just the connected devices and in-depth understanding of artificial intelligence. It’s mapping.

Apple and Google maps are so far the best mapping systems in the world. Seemingly, Google Earth and Google’s Street View weren’t developed for the company’s CEO but to enable autonomous cars to work efficiently using accurate mapping data. No wonder BMW, Audi and Mercedes-Bencz jointly acquired Nokia’s Here map system in 2016. And the race for the world’s most accurate mapping data continues.

It’ worth keeping in mind that even though the conventional car makers seem to be stuck in the existing dealership model, new comers are likely to be the game changer, removing one of the least user-friendly sides of the automotive sector from the complex equation. Next time you’re in the city, try comparing the experience at an Apple Store and that of your local car dealer.

Finally, we see two powerful industries that are about to clash. The ordinary car is about to be transformed in ways we never ever imagined. Certainly, the emergence of autonomous cars, electric cars and connected cars will change the automotive industry faster in the next decade than it has happened in the last 50 years. This is likened to the transformation from horse-drawn carriage to the vehicle. Tell me, how many horse-carriage makers can you name?

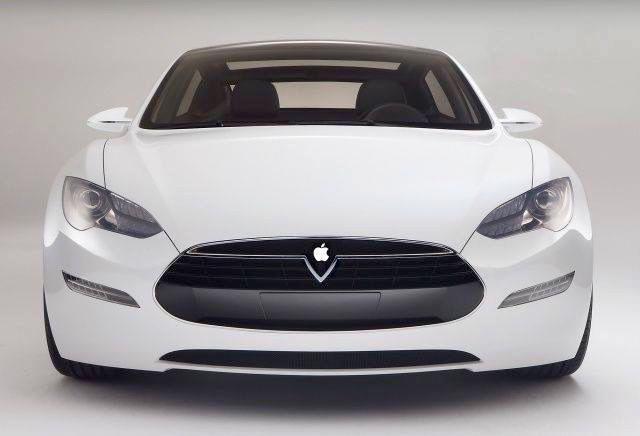

IMAGE via L P Y 9 7 4