In the coming decade, the conventional large utilities in Australia are likely to become extinct if Sonnen, the leading German domestic battery provider gets its way.

The number one battery player in Europe, Sonnen, plans to roll out its revolutionary free power agreement to its Australian consumers within two months, a move the company’s managing director, Mr. Oliver Koch says will render obsolete all conventional electricity supply offers.

“We believe that traditional energy infrastructure and traditional energy companies will be dead in 10 years’ time,” said Mr. Koch.

The “Sonnen flat” agreement ensures free electricity to all households purchasing integrated solar and storage system from the Bavaria-based company and this includes the excess power a home will require to import from the grid besides its rooftop output.

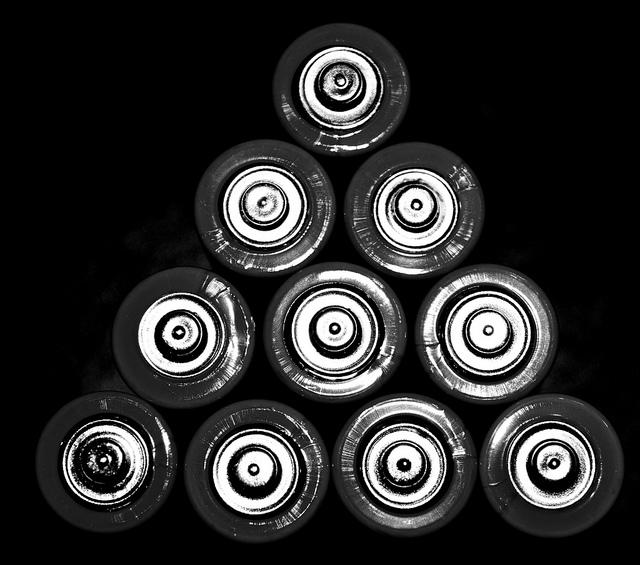

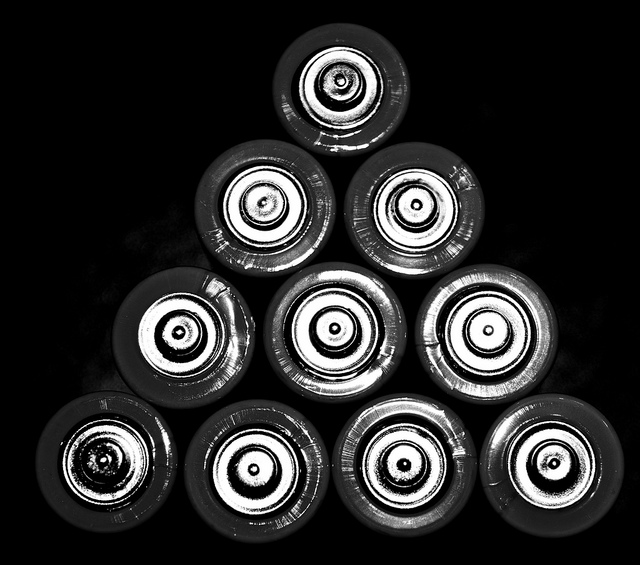

Thousands of storage batteries deployed

In exchange, Sonnen will have the discretion power to call on consumers’ batteries storage capacity to ensure short-term grid balancing solutions are available to all network operators.

“In times when the grid operator needs power because the demand is too high we can deploy thousands of batteries within a second to provide megawatts of energy to the grid,” Mr. Koch said.

Sonnen initiated the deal last year with 6000 of its loyal clientele in Germany and is now expounding the offer to its customer base in Australia, Italy and Switzerland, with the launch in Australia expected to begin “in the next couple of months”, he said in a statement.

The systems will be introduced on the Australian market at a cost of $6000 for a complete installation at a range of up to 25,000 depending on the modular-designed batteries to be installed. The average price for a household could be around $11,500, producing about 60,000 KWh over the solar battery’s life, said Chris Parratt, the head of Sonnen in Australia.

In Contrast, Mr. Parratt estimated that Tesla’s Powerwall 2 would be available at approximately the same price, generating around 39,000 kilowatts-hour during its life span. He added that Sonnen customer paybacks are currently operating at six to nine years, based on the customer and their states, with households in Queensland and South Australia expected to receive their money back more rapidly than those in New South Wales and Victoria owing to the existing higher tariffs.

Sonnen hopes its offer will prove irresistible for customers in the fast-emerging Australian storage market, with rising dissatisfaction over the ever skyrocketing power bills. Most Australians are shocked with their power bills even after the generous feed-in tariffs came to a close on 31 December last year in NSW.

“Those customers that have come off [feed-in tariffs] are prime targets for a storage unit: they are now paying an electricity bill where they weren’t before,” Mr Parratt said.

Sales Expected to Increase by double digits

The total sales of storage batteries in Australia are expected to double in 2017 by about 10,000 units, after its popularity increased since January last year, Mr Parratt said. Sales recorded in 2015 totaled around 100, and were mostly to early tech adopters. It’s anticipated that the growth will be more rapid, even a solar analysts at SunWiz predict the sales will treble this year.

Mr. Koch noted that the market has really changed considering that households are in favour of “cheap, green electricity” as opposed to a battery.

Mr. Koch also emphasized that the regulatory set up in Australia, along with its competitive Frequency Control Ancillary Services market only means that the “Sonnen flat” model must work here just like it does in Europe.

Sonnen will rival other established power stations that fall under the six-second primary frequency response market where applicants have to respond promptly with their approved capacities within six seconds. Existing market prices can increase above $5000 a megawatt when the main grid experiences an abrupt imbalance between demand and supply.

Approximately 300 residential customers that are connected to “virtual power plant” that would avail about 1MW capacity that Sonnen can submit into the market, allowing the company to comfortably meet the cost of offering free electricity to its consumers. The company notes that the short span of time when the FCAS market taps into the storage batteries’ potential only means consumers would hardly notice any drop in performance of their battery.

Mr. Koch likened the transformation in the market for energy sales offers to the change witnessed in the mobile phones, which has actually moved from service payment per minute of use and every SMS sent to a flat package that covers all services.

“The incremental cost of producing that extra minute of phone conversation to Telstra or Optus is zero … and the same will be true for energy,” he added.

“That business model where you just pass on costs to the customer will be outdated soon.”