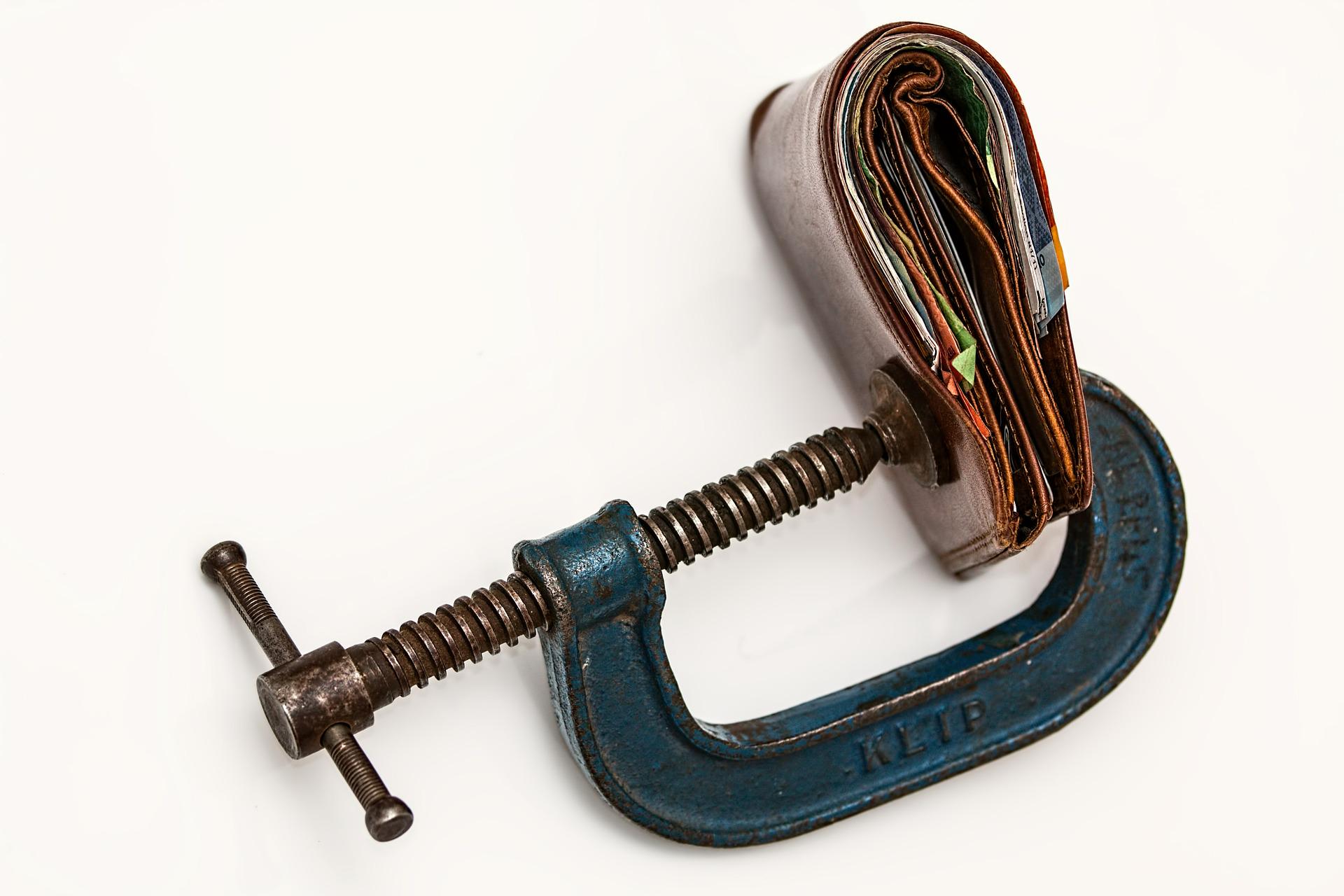

Tax breaks for small businesses and those that fall within the top tax bracket took effect yesterday, and are likely to weigh so heavily on people’s hip pockets. Consequently, electricity bills are expected to rise by about 15 to 20 per cent across the country this financial year.

Mr. Howard Wu, the manager of a Canberra Chinese restaurant said his business already incurs huge bills in relation to heating and powering its fish tanks and food refrigeration.

“It’s very difficult to maintain profit if the price continues to go up,” he told SBS World News. In the past few weeks, the biggest energy companies in Australia such as Origin, AGL and Energy Australia have indicated massive price hikes. The most significant increases for households and businesses will be recorded in New South Wales, South Australia, and the ACT with the average business in Adelaide paying an additional 1,500 in the next 12 months. Energy providers are pointing fingers at the recent shut down of coal-fired power plants and the growing demand for gas.

However, John Bradley, the CEO of Energy Networks Australia has a different view. He claims it’s all in the hands of customers who can significantly lessen the impact of the pinching electricity prices by taking time to shop around for the best deal. “This will be a real impact on customers that are just sitting there accepting their current retailer’s price increases,” Mr Bradley said. “But if customers are shopping around and looking for the best deal, figures indicate they could be saving between $200 to up to $600, depending on where they live.” Based on your income level, your total tax payable changed yesterday. For instance, the highest tax bracket for those earning above $180,000 annually will enjoy a tax cut as they won’t be required to pay the two per cent budget repair levy.

Small businesses are beneficiaries too and will start enjoying a tax break expected to phase in gradually. Unfortunately, online shoppers will be derailed by the so-called Netflix Tax which is applicable to imported digital products and services including software, streaming services, and video games. Those working in the hospitality, fast food, pharmacy and retail sectors, and who are protected by industry awards, will experience cuts to Sunday penalty rates that phased in yesterday. Bill Shorten, the Labor leader said it was unfair for high income earners to pay less tax while weekend casuals that fall in low income brackets faced a pay cut.

“Tomorrow is a dark day for Australia’s work force,” Mr Shorten told reporters in Brisbane. “Peoples’ penalty rates are getting cut. All Malcolm Turnbull wants to do is give large corporations a tax cut and look after his mates, the millionaires.” On a more positive note, the lowest paid workers in the country will see a small increase in their minimum wage, approximated at about $20 extra each week. On the other end of the spectrum, politicians will get a two per cent payrise with Malcolm Turnbull’s salary increasing by about $10,000.

The government will also effect its new tax on the five most established banks in Australia– Westpac, NAB, ANZ, Macquarie and Commonwealth. Notably, some banking chiefs warn that this cost would be passed on to clients and shareholders. Changes to superannuation will also be effected including an $80,000 cutback in the after-tax contributions cap, while the new $1.6 million dollar cap on tax-free pension phase super accounts will affect the high-income earners.